Bharti Airtel, Reliance Jio set for home broadband war

As Mukesh Ambani-led telco readies to launch fibre-to-the-home services later this year, Sunil Mittal-led telco is gearing up with attractive offers to counter another price war

Consumers of home broadband services can look forward to a bonanza of sorts in coming months with Bharti Airtel ready to engage in another price war once Reliance Jio Infocomm launches its much awaited fibre-to-the-home (FTTH) services later this year.

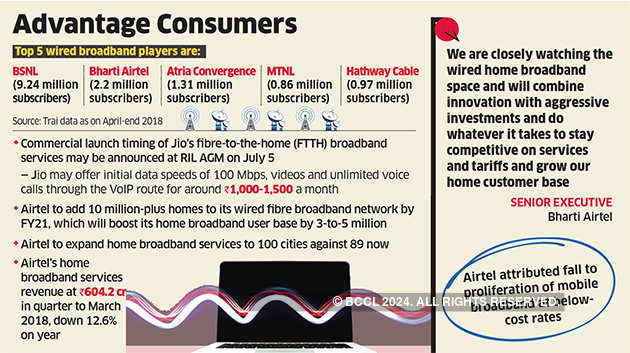

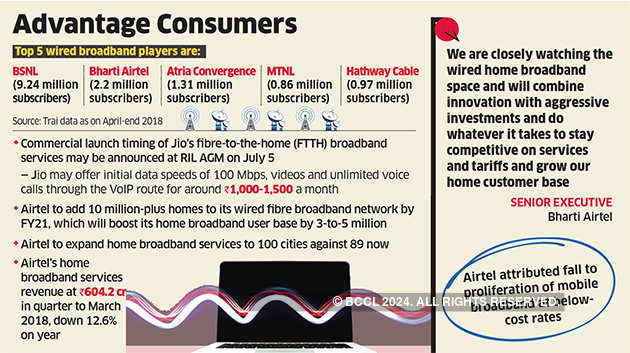

Consumers of home broadband services can look forward to a bonanza of sorts in coming months with Bharti Airtel ready to engage in another price war once Reliance Jio Infocomm launches its much awaited fibre-to-the-home (FTTH) services later this year.After unleashing brutal price wars in the mobile services space with its disruptive tariffs following its entry in September 2016, the Mukesh Ambani-controlled 4G carrier is now poised to stir a hornet’s nest; this time in the home broadband services front by offering an attractive combo of fast broadband connectivity at initial data speeds of 100 Mbps (with huge dollops of free data thrown in), videos and unlimited voice calls through the Vo-IP (voice over internet protocol) route for around Rs 1,000-1,500 a month.

But many expect Jio — which is already running a pilot in many cities — to offer its bouquet for free initially to attract customers, mirroring its strategy in the mobile phone space.

A person familiar with the developments hinted that the timing of the commercial launch of Jio’s home broadband services may be revealed at parent Reliance Industries’ upcoming annual general meeting on July 5.

Small wonder, Sunil Mittal-led Bharti Airtel is revving up its countrywide wired broadband game to protect turf ahead of Jio’s commercial roll-out of its ultra-fast home broadband services.

“We are closely watching the wired home broadband space and will combine innovation with aggressive investments and do whatever it takes to stay competitive on services and tariffs and grow our home customer base,” a senior Bharti Airtel executive told ET.

The No.1telco is likely to set aside a sizeable chunk of its Rs 24,000-crore capex guidance for FY19 to expand its pan-India wired broadband network to at least 100 key cities from the 89-odd now, primarily targeting big data consumption zones.

In them, the telco has finalised plans to connect another 10 million-plus homes by FY21 that it expects will translate in at least 3-to-5 million new home service customers over the next three years.

Airtel is also working to put together a winning brew of offers at attractive rates to hold on to their 2.5 million-strong home broadband customer base. The company has recently offered discounts of 15% and 20% to customers opting for its home broadband packs (offering up to 300 Mbps speeds) for six months and 1 year, respectively.

Another key element of Airtel’s home broadband strategy to counter Jio is the chase for full-fledged home customers, who will be incentivised by way of discounts to buy converged telecom products across Airtel’s full services portfolio under its ‘Home Platform’, which will soon go commercial nationally.

Under the digital home platform — developed in-house by the company’s innovation team — home customers will, typically, be able to bundle Airtel postpaid mobile and digital TV connections with their high-speed home broadband packs and consolidate all bills into one.

It may also roll-out a host of specialised ancillary services for its home broadband customers, including home surveillance solutions and anti-virus tools, said another company executive.

Reliance Jio and Airtel did not reply to ET's queries till press time on Wednesday.

“An aggressive FTTH services launch by Jio can cause two sets of disruptions, in that, it can immediately disrupt home broadband pricing, forcing rivals such as Airtel market, if Jio chooses to bundle generous wired broadband packs with its current 4G plans,” Rohan Dhamija, partner & head for India, South Asia & Middle East at Analysys Mason, told ET.

forcing rivals such as Airtel market, if Jio chooses to bundle generous wired broadband packs with its current 4G plans,” Rohan Dhamija, partner & head for India, South Asia & Middle East at Analysys Mason, told ET.

Airtel has already felt the effects of pre-empting Jio’s launch, being forced to cut rates for some of its plans and increase data allowances.A person familiar with the developments hinted that the timing of the commercial launch of Jio’s home broadband services may be revealed at parent Reliance Industries’ upcoming annual general meeting on July 5.

Small wonder, Sunil Mittal-led Bharti Airtel is revving up its countrywide wired broadband game to protect turf ahead of Jio’s commercial roll-out of its ultra-fast home broadband services.

“We are closely watching the wired home broadband space and will combine innovation with aggressive investments and do whatever it takes to stay competitive on services and tariffs and grow our home customer base,” a senior Bharti Airtel executive told ET.

The No.1telco is likely to set aside a sizeable chunk of its Rs 24,000-crore capex guidance for FY19 to expand its pan-India wired broadband network to at least 100 key cities from the 89-odd now, primarily targeting big data consumption zones.

In them, the telco has finalised plans to connect another 10 million-plus homes by FY21 that it expects will translate in at least 3-to-5 million new home service customers over the next three years.

Airtel is also working to put together a winning brew of offers at attractive rates to hold on to their 2.5 million-strong home broadband customer base. The company has recently offered discounts of 15% and 20% to customers opting for its home broadband packs (offering up to 300 Mbps speeds) for six months and 1 year, respectively.

Another key element of Airtel’s home broadband strategy to counter Jio is the chase for full-fledged home customers, who will be incentivised by way of discounts to buy converged telecom products across Airtel’s full services portfolio under its ‘Home Platform’, which will soon go commercial nationally.

Under the digital home platform — developed in-house by the company’s innovation team — home customers will, typically, be able to bundle Airtel postpaid mobile and digital TV connections with their high-speed home broadband packs and consolidate all bills into one.

It may also roll-out a host of specialised ancillary services for its home broadband customers, including home surveillance solutions and anti-virus tools, said another company executive.

Reliance Jio and Airtel did not reply to ET's queries till press time on Wednesday.

“An aggressive FTTH services launch by Jio can cause two sets of disruptions, in that, it can immediately disrupt home broadband pricing,

forcing rivals such as Airtel market, if Jio chooses to bundle generous wired broadband packs with its current 4G plans,” Rohan Dhamija, partner & head for India, South Asia & Middle East at Analysys Mason, told ET.

forcing rivals such as Airtel market, if Jio chooses to bundle generous wired broadband packs with its current 4G plans,” Rohan Dhamija, partner & head for India, South Asia & Middle East at Analysys Mason, told ET.This has led to its home services revenue shrinking nearly 11% on-year to Rs 604.2 crore in the quarter ended March, triggered by 12.6% on-year ARPU dilution. Airtel attributed the fall to “the proliferation of mobile broadband at below-cost rates”.

Comments

Post a Comment